Managing small business payroll entails taking into account everything from establishing your company as an employer to paying your workers, tax authorities, and other pertinent organizations. There are several procedures you must carry out while learning how to process payroll to comply with all applicable federal and state rules.

While small company owners often have a strong understanding of the goods or services they provide, not everyone has the expertise or time to manage all payroll tasks. We suggest Gusto to those tiny company entrepreneurs. It is a comprehensive payroll solution that computes payroll, submits taxes and other paperwork, and even provides HR resources. To begin a 30-day free trial, click the link below.

Follow the eight steps listed below if you’d like to learn how to process payroll yourself. To assist you, we’ve also created a free checklist that you can download and watch.

8 Steps To Use To Manage Your Small Business’s Payroll

Step 1: Set Up Your Business as an Employer

The first stage in handling payroll is confirming that your company has complied with all legal requirements to function as an employer, supposing you have previously formed your business and submitted any necessary licensing applications. You should also take into account any payroll regulations that are relevant to your sector.

- Request a Federal Employer Identification Number (EIN).

- Check to see whether your state’s tax identification number matches your federal one; if not, find out if you need to apply for one or if one is issued to you automatically.

- Join the Electronic Federal Tax Payment System and create an account.

- Open a second bank account from your main company account only for payroll transactions.

- Enroll in any state electronic tax payment accounts that are relevant.

- Get workers’ compensation insurance; most states mandate it.

Step 2: Establish Your Payroll Process

You must now decide on a few things that will affect how you manage payroll each pay period. To make sure your crew is adequately taught the procedure, you must decide what would work for your company.

Looking to improve the effectiveness of your payroll process management? See our best advice for handling payroll efficiently.

Look into the “why” underlying each topic. Be careful to take any legal obligations into account as well as the demands of your company and workers.

- Will you be making weekly, bimonthly, or semimonthly payments?

- What are the different (non-contract) employee types: full-time vs. part-time? Exempt versus nonexempt?

- Will you need to keep track of your working hours? If so, how will you go about doing so and when must they report to you?

- Benefits: Are you going to provide benefits? Who will cover their costs? How will you handle payroll deductions if workers are covering them entirely or partially?

- Taxes: Which taxes are you liable for and how frequently will you have to pay them? Will state taxes be required of you? Local? Ahead of time, learn the rates so you can calculate how much to withhold.

- Are you going to process and compute payroll using Excel, by hand, with a calculator, or by utilizing a payroll service?

- Paychecks: Are you going to write checks or will you use direct deposit? debit cards? Cash?

Also Read: Anime Black Clover 2nd Arc New Season Release Date

Step 3: Collect Your Employees’ Payroll Forms When Hired

To operate payroll effectively, you’ll need several crucial documents from your workers, which are ideally obtained during their onboarding. These contain tax and work permission documents, both of which must be signed by the staff members.

If you have an HR system or payroll system, you will use the information on the forms outlined below to add the employee to it. Keeping this data in a paper file or an electronic personnel file is a smart idea.

Additionally, you must enroll your employee in the New Hire Reporting Program of your state (often within 20 days). Make sure to notify your state of any new or rehired personnel. Gustol and other payroll applications often submit these reports automatically.

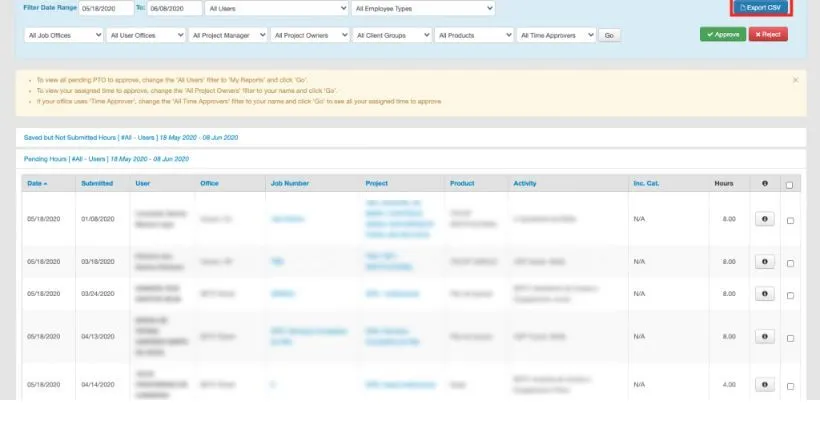

Step 4: Collect Time Sheets, Review & Approve

You may now begin gathering information about the amount of time your workers spend working to decide how much you should pay them. If you pay hourly personnel, you must determine the total number of hours they put in throughout the period. Although salaried workers normally get the same income every pay period, you may still keep track of their work hours if necessary. The employee only has to record their start and finish timings for each day, add up the hours worked (lunch breaks are not included in the total), and have their answer for the number of hours worked.

Most companies begin with a simple timesheet. As companies develop, they often upgrade to a time clock or a time and attendance system to control staff schedules, break times, and hours worked. Here is an example of an electronic timesheet from Homebase, one of our top picks for free timekeeping software.

Step 5: Payroll Calculations

You may begin doing the crucial payroll calculations after you know how many hours an employee worked throughout the pay period. Included in it are gross pay, any taxes owed, insurance premium, and other benefit deductions, as well as final net pay.

Calculating Gross Pay

Simply add up the straight-time hours (up to 40 in a workweek) and multiply the total by the employee’s hourly rate to determine gross compensation. Apply the workers’ overtime pay rate to the total number of overtime hours they worked during the pay period. While overtime is often computed at 1.5 times the ordinary rate of pay, straight time is paid at the employee’s regular pay rate.

Why Are Properly Managed Payroll Processes So Important?

One of your most important responsibilities as an employer is to pay your workers correctly and on schedule. A failure to pay your workers fairly and regularly might have a significant negative effect on your company.

For instance, almost half of workers start looking for a new job after only two paycheck problems, which means you won’t keep the best staff you’ve recruited.

Mismanaged payroll procedures, however, go beyond tardy employee payments. Many organizations struggle to appropriately categorize their workers, figure out and deduct employee taxes, and maintain payroll databases because of poorly handled payroll. Employer penalties issued by the IRS for incorrect computations or late payments of employment taxes are expected to total $6 billion in 2020 alone.

A well-managed payroll process is more than simply an HR exercise; it’s your legal and duty-bound obligation since it may affect employee morale and expose you to serious financial danger.

Calculating Taxes & Payroll Deductions

You must plan your payroll deductions if you want to complete it. Deductions include federal and state payroll taxes, any perks you provide, and extras like Social Security or unemployment insurance.

A list of possible deductions is provided here, along with links to further resources on topics like figuring out what to deduct for each employee. Deductions are handled automatically if you utilize payroll software like Gusto.

Examples are:

- Medicare and Social Security (FICA)

- (FUTA) Federal Unemployment Tax

- Deductions determined by:

- Perks you provide workers, such as health insurance

- Taxes were taken out of employee tips

- Extraordinary deductions, like a uniform expenditure

To handle these deductions, sum up all of the employee deductions to reach a total, and then take that amount from the employee’s gross salary. As an alternative, you may break out each deduction into its line item and take each one away from the employee’s gross pay until you have calculated their net pay.

Our article on payroll calculations could be more appropriate if your main payroll-related difficulties are numerical in nature. Just make sure you are also well-versed in the standard procedures you need to follow while processing payroll.

Free Payroll Calculators

To make processing payroll yourself even simpler, use the calculators in the articles below.

Step 6: Pay Employees, Tax Agencies & Benefits Providers

You will know the net amount you need to pay each employee, as well as the totals for employment taxes and benefits you must pay after you deduct deductions from gross pay. So that workers always know what to anticipate, be sure to stick to the payment schedule you first established (if you committed to paying salaries every Friday, leave yourself adequate time to process).

The due dates for taxes and benefit providers vary. Although it might vary, many companies are obligated to pay these costs every month. In addition to whatever employer payroll tax and premium amount your company pays, you’ll also need to pay the money you deducted from your workers’ paychecks.

Also Read: Business Insider.de : The oldest dog in the world doesn’t eat dog food and celebrated its 31st birthday with over 100 guests.

Step 7: Do Year-end Payroll Tax Reports

You’ll need to be ready to issue year-end payroll tax reports as the end of the year approaches. By January 31 of the following year, employees must get their W-2 forms, which must include information about their total wages and taxes paid. Prepare 1099-NEC forms in their place if you’re paying independent contractors; they’ll display earnings but no taxes.

Step 8: Document & Store Your Payroll Records

You must keep detailed records for each paid month to comply with federal labor rules. Save any payroll records, including timesheets, pay stubs, and details of pay raises.

The papers are currently available online or may be submitted and added to the employee record if you’re using software like Gusto. If you manually manage papers, you should make sure they are kept in a safe location.

Conclusion

In conclusion, handling your small company’s payroll effectively is essential to operating a profitable and legal organization. You can expedite your payroll procedure, prevent expensive mistakes, and make sure that your workers are paid properly and on time by adhering to the eight procedures described in this blog article. Keep in mind that maintaining accuracy, consistency, and compliance are essential for efficient payroll administration. Establishing a strong payroll system will pay off in the form of a highly motivated team and a successful company.