One of the best programs for keeping financial records and budgeting is QuickBooks. It assists both small and large organizations in managing and maintaining financial records for things like spending, invoices, payments, taxes, etc. Many processes have been made simpler as a result of this accounting software. With only a few clicks, you can learn everything about your company at any moment. One of QuickBooks’ finest features is the balance sheet. Continue reading if you want to learn more about balance sheets in QuickBooks.

What is a QuickBooks Balance Sheet?

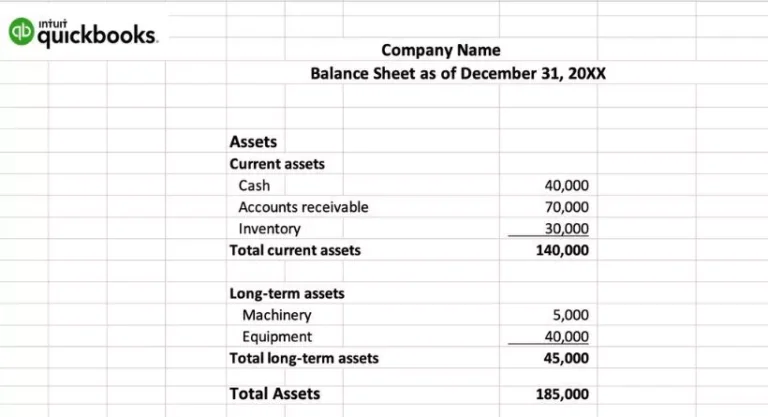

A company’s or industry’s financial position is summarized on a QuickBooks balance sheet. Liabilities, assets, and equity make up its three main parts. a financial statement that offers a corporate overview and aids in determining profit and loss.

You can easily determine whether or not the firm is profitable through the equity part, which is the final section. It demonstrates how obligations and assets differ from one another.

Importance of Balance Sheet

What a firm possesses at a certain time is shown on the balance sheet. It exposes the company’s true value. Whether or whether a corporation has taken a lot of money, it may easily view its financial records with the use of a balance sheet. Consequently, you are aware of the significance of a balance sheet for any industry.

How to Use QuickBooks Balance Sheets?

Running the QuickBooks balance sheet is fairly simple. All of you must take the quick actions outlined below:

Select “Reports” from the left menu, then “Business Overview,” then “Balance Sheet.”

Here, you will discover a variety of additional choices for customizing your QuickBooks balance sheet. You may see and modify the sheet by scrolling up and down. You can utilize a variety of tools as you see fit.

How to Create a Balance Sheet in QuickBooks?

Every facet of QuickBooks, from its significance to its meaning, has previously been covered. It’s time to learn how to manufacture a sheet now. Creativity is simple. Using the methods below, you may easily make one.

- On the left navigation bar, click.

- Tap Reports, and then choose a company overview.

- The option labeled Balance sheet is visible here.

- The choices for your balance sheet must now be configured.

Here are some of the fundamental choices you have for the balance sheet QuickBooks report.

Report Period

You can choose the period for which you are preparing the financial statement in this column. This period’s profit would be shown at this time. You can either select the time that is offered or alter it to suit your preferences.

Display Columns By

There is just one column in the QuickBooks sheet, but you may choose from a variety of columns in the online version of the QuickBooks Balance sheet. There are choices for quarterly and interim balances in the web sheet. Here, we’d like to recommend that you take use of the online balance sheet option for its added capabilities. According to your demands, you may add other columns for things like suppliers, classes, and location.

Compare Another Period

You may compare your business profitability with this function. The most used feature you have access to is this one. Making a second column just for comparison can simplify your job by eliminating the need to manually compare the data. Additionally, you may assess your comparison using figures or a percentage.

Accounting Method

The accrual method and the cash method are your two choices for the accounting approach. You may select either. Select the accrual option if you want your sheet to display all of the accounts using the accrual approach; if you prefer the cash method, use the cash option. Accounts payable and receivable are features of accrual accounting.

Run Report

You will have the opportunity to execute the report after providing all of your balance sheet information. Then, when you choose to run the report, you may see your personalized sheet.

QuickBooks Balance Sheet customization

Your balance sheet may generally be customized in four different ways. By choosing the customize option that is shown to you, you may modify your document. General, header, footer, filter, rows, and columns are just a few of the choices available. So let’s examine what each of these choices represents.

General

The very first area of the balance sheet that you may change is this one. Only in this part are you able to choose the time frame and the accounting technique.

Header/Footer

You simply can choose what you want in your header & footer and can change the default information as per your choice. You also can place checks on the fronts of any column.

Rows/Columns

You can choose the appropriate rows and columns first. After doing this, you may move any column up or down to suit your preferences. This will make it simpler for you to assess your financial statement.

Filter

Your task is easier with this choice. Your balance sheet may be filtered using Filter based on five criteria: auction, suppliers, customers, classes, and products.

How to Export QuickBooks Balance Sheet?

Your balance sheet is simple to export. You also have the choice to email, print, or PDF as additional alternatives. You can export using the procedures listed below:

- Select an option by clicking in the upper right corner.

- Select the available message icon from the mail.

- Click the print button to start printing.

- Simply select the PDF option and then click “Export” to acquire the PDF.

Conclusion

In a word, We have given you a thorough understanding of the QuickBooks Balance sheet and how it gives you the financial statements of the organization. You could have understood every element of using the QuickBooks Balance sheet from the article above. After reading this article, creating balance sheets will be simple. You can contact us in the comments area if you still have questions or are confused.