Staffing your business can be done through different talent acquisition options. The two most popular work arrangements are hiring W-2 employees or 1099 contractors. Although they share some similarities, there are significant differences between them that can impact your business. At Complete Payroll Solutions, our HR team assists numerous companies in managing their employees.

Our expertise is often sought after to help businesses understand the pros and cons of W-2 and 1099 workers for specific positions, along with the critical distinctions between the two. Proper classification is crucial to avoid unpaid payroll taxes, fines, and penalties, as well as potential violations of state law, depending on your location.

Misclassifying workers as 1099 contractors instead of W-2 employees is a common mistake made by many employers. In this article, we will guide you on how to navigate the two arrangements and help you understand the differences between them. You will learn which type of worker is most suitable for your business and how to ensure proper categorization. Our comprehensive breakdown will cover several critical areas that differentiate W-2 and 1099 workers, including:

- The amount of control you have over their work

- How their duties compare

- The expenses you’ll incur

- What payroll taxes you’ll have to pay

- Benefits they’re entitled to

- Their impact on culture

What is a W-2 Employee?

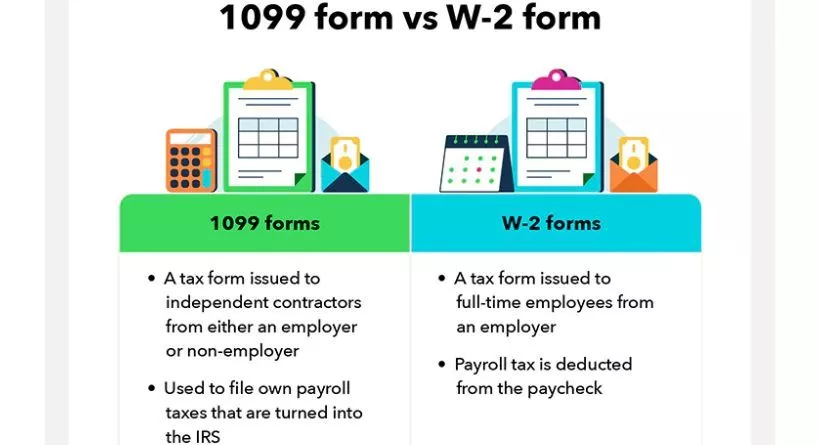

Whenever you bring on a part-time or full-time employee, they are classified as W-2 workers. This classification stems from the fact that you will report their annual wages and all forms of compensation using a Form W-2. The Form W-2 will also itemize the withholdings made from your employee’s pay. It is this form that your employees will use to report their income during tax season.

What is a 1099 Worker?

If you engage an independent contractor and pay them at least $600 for their services, their compensation will be reported on Form 1099-NEC. It’s important to note that the terms used to refer to 1099 workers can vary and may include designations such as self-employed individuals, freelancers, or gig workers. These workers are essentially business owners who offer specific services to your company and are not on your payroll like traditional employees.

The Amount of Control You Have Over a W2 Vs 1099 Worker

The primary difference between W-2 and 1099 workers is the level of control you have over their work. When you hire a W-2 employee, you have the authority to manage their work by providing them with instructions, training, tools, and equipment necessary to complete the job. Additionally, you set their work hours and schedule.

On the other hand, according to the IRS’s employee vs contractor fact sheet, a worker is classified as an independent contractor if you only control the outcome of their work and not the process, timing, or methods they use to achieve it. Therefore, 1099 contractors utilize their tools and methods to complete the work, and they operate on their schedules. Although they may work on specific projects or for a set period, they have the flexibility to accept or decline work from other businesses.

The correct classification of workers is crucial, and the IRS offers guidelines to assist you in determining whether a worker should be classified as an employee or contractor. These guidelines assess the extent of control you have over the worker to establish their classification.

- Behavioral Control: Evaluate whether you have the authority to direct the worker’s actions and methods of work. If you do, then the worker is likely an employee. However, if the worker has the freedom and discretion to complete the job, they are likely a contractor.

- Financial Control: Determine if you control the financial aspects of the worker’s job, such as how they are paid and reimbursed for expenses. If you have control, then the worker is more likely an employee. However, if the worker incurs their expenses, this points more to a contractor arrangement.

- Relationship: Determine if there is an ongoing relationship with the worker and if they receive benefits. If you answer yes to these questions, the worker is likely an employee. This is also the case if the work performed is a critical aspect of your business.

If you require further guidance, you can request the IRS to decide by filing a Form SS-8.

How a W2 Vs 1099 Worker’s Duties Compare

Managing W-2 employees gives you complete control over the tasks they perform, as well as how and when they are completed. With this level of oversight, you can assign a wide range of responsibilities to your team and ensure they are focused on the areas where they are needed most. By contrast, 1099 contractors are hired for specific projects and given the autonomy to complete them as they see fit. While this allows you to avoid micromanaging their time, it also means you cannot assign additional tasks without changing the scope of your agreement.

Furthermore, 1099 contractors typically set their hours and deadlines, which may impact their reliability if they have other clients to work with. In contrast, W-2 employees have set schedules and are dedicated solely to your business. Overall, both types of workers have their benefits and drawbacks, and it’s important to consider your specific needs when deciding which type of worker is best for your business.

The Costs of W2 Vs 1099 Workers

While W-2 employees may cost less per hour than independent contractors, there are other expenses to consider. As an employer, you are responsible for managing payroll and making tax contributions, including Social Security, Medicare, state unemployment compensation insurance, and workers’ compensation. Additionally, you must factor in the cost of benefits, office space, and equipment, as well as the ongoing challenge of managing and motivating employees.

In contrast, 1099 contractors offer significant cost savings. Since you don’t have to manage payroll or make tax contributions, you can expect to save between 20 and 30 percent when hiring an independent contractor. Furthermore, contractors can help you save money in other ways, such as by providing their equipment and workspace. If you’re looking to cut costs, hiring a 1099 contractor may be a smart solution.

- When they quit the position, you won’t have to reimburse them for any unused vacation time or other costs.

- You might be able to spend less on training because many 1099 employees specialize, but they’ll take their abilities with them when they go.

- You may save money on legal fees associated with allegations made against you because contractors are not afforded the same legal safeguards.

- It won’t cost you anything to buy supplies, tools, or gas.

Payroll Taxes for W2 Vs 1099 Workers

Payroll taxes for W-2 employees are automatically taken out of their paychecks. As the employer, you deduct income taxes from employee wages and pay Social Security, Medicare, and unemployment taxes. As was previously mentioned, you must provide employees with a W-2 at tax time that details the sum of these taxes that were deducted from their pay.

If an independent contractor received $600 or more throughout the year, you must issue a Form 1099-MISC to record what you paid. These 1099s are used by contractors to tally their net income and determine their self-employment tax, which they must then send directly to the IRS. Due to employers covering half of the payroll taxes, the self-employment tax, which is 15.3%, is double what a W-2 employee pays. The one benefit for 1099 workers in terms of taxes is that the majority of the costs they incur to execute their employment can be written off.

W2 Vs 1099 Worker Benefits

The statute provides safeguards to W-2 employees, including minimum wage, overtime pay, and family and medical leave. Additionally, kids have a right to make use of your benefits, which frequently outweigh the ones they could buy on their own and include things like health and dental insurance. Offering a competitive package can go a long way toward making staff members feel valued, which can enhance output and performance. But as you are aware, advantages can be pricey. The Bureau of Labor Statistics discovered in March 2020 that benefit expenses made up 29.8% of private sector employees’ income and compensation.

The Bureau of Labor Statistics discovered in March 2020 that benefit expenses made up 29.8% of private sector employees’ income and compensation.

You don’t have to worry about providing employer-sponsored benefits to 1099 workers. Additionally, independent contractors are not required to pay for workers’ compensation or unemployment insurance, saving you money on these costs.

The Impact of W2 Vs 1099 Workers on Culture

You can hire people who fit well within your company and who uphold your principles by using W-2 workers. These employees join your team, improve the work atmosphere, and contribute to a better business culture, which can aid in both recruiting and retention. Employees may also feel more confident in their positions, which may help them concentrate better because they won’t constantly be looking for their next opportunity.

Generally speaking, 1099 contractors are less committed to the corporate culture. This is so because they often finish one task or assignment before moving on to the next. And that could be disruptive to the culture and other employees. However, as there is no requirement to continue working with a contractor after their assignment is complete, it is simpler to stop a relationship with a contractor than it is to fire an employee, the transient nature of 1099 workers can be a benefit.

Should You Hire a W-2 Employee or 1099 Worker?

There are several factors to take into account whether you hire workers as employees or engage in contractor agreements. Your organization and your ability to accomplish your goals can benefit from one or both types.

A W-2 employee is a good fit if you:

- Want devoted personnel who will be dependable and effective over the long run.

- like to maintain internal knowledge and capabilities of staff

- Have a unique corporate culture that you wish to promote and uphold.

1099 workers could be right for your business if you:

- Want to keep your costs low and avoid paying payroll taxes or perks

- would rather bring in specialized skills than devote the time or expense to training

- Do you desire the freedom to end a connection when a project is over or when your budget permits?

Even whether you hire someone as a W-2 employee or 1099 contractor, it’s recommended practice to review their job periodically because the nature of the relationship may change. Misclassifying your employees can have serious financial repercussions. Read our next post, Who is a 1099 Worker? for additional details on the distinctions between these two categories of workers.